28+ tax deductions for mortgage

Web California Income Tax Calculator 2022-2023. Web Mortgage Interest Deduction.

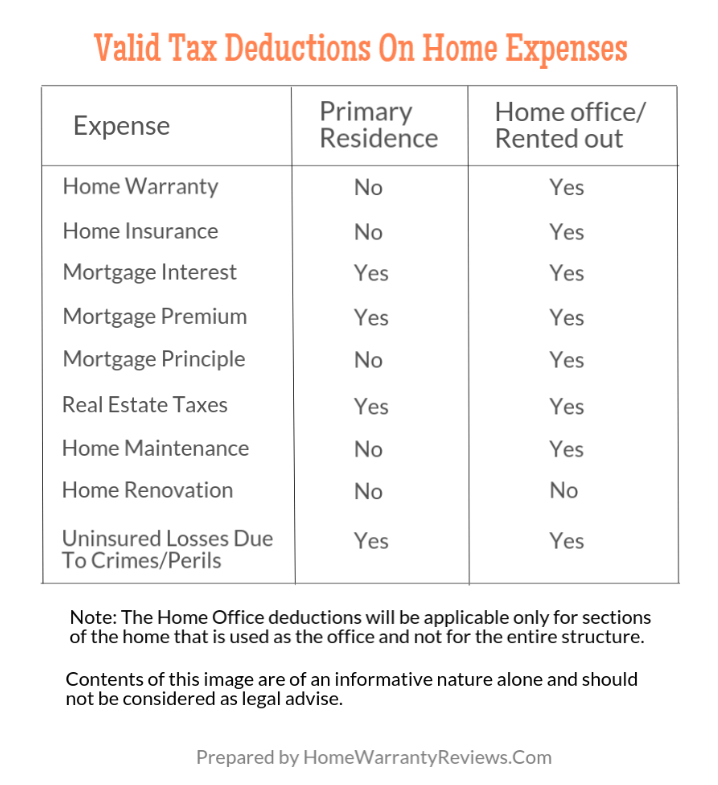

Are Home Warranty Premiums Tax Deductible

When you make your mortgage payments you may have been surprised at how much of your money was going towards interest.

. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Your average tax rate is 1167 and your marginal tax rate is. For taxpayers who use.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

10 Best Home Loan Lenders Compared Reviewed. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Private Mortgage Insurance PMI Premiums.

Homeowners can deduct what they paid in mortgage interest when they file their taxes. Credits are valuable tools for lowering liabilities and boosting refunds and there are numerous available to families that unlike. Web Read IRS Publication 936 Home Mortgage Interest Deduction to learn more.

However higher limitations 1 million 500000 if married. Web Currently you can deduct the interest on up to 750000 of mortgage debt if youre single or married and filing jointly and up to 375000 if youre married and filing. Comparisons Trusted by 55000000.

Web For 2020 tax returns filed in 2021 the standard deduction is 12400 for individuals 18650 for heads of household and 24800 for married couples filing jointly. If your down payment was less than 20 of your. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. A document published by the Internal Revenue Service IRS that provides information on deducting state and local sales taxes from federal. But for loans taken out from.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. Taxes Can Be Complex. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

You can file between January 23 and April 18 2023. Take Advantage of Credits. Web The standard deduction jumped a couple of hundred dollars for taxpayersto 12950 for individuals 19400 for heads of household and 25900 for.

Web It is required that the loan was made in 2007 or later and it has to be either for a primary residence or a second home that you are not renting out. Mortgage interest Many US. If you make 70000 a year living in California you will be taxed 11221.

Taxes Can Be Complex. Taxes with an extension must be completed no later. Web Mortgage interest.

So if your rate on a 200000 mortgage is 35 and you pay 4000 for two. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. You can file for an extension by April 18 2023.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web IRS Publication 600. Web When you file your tax return you must decide whether to take the standard deduction-- 12950 for single tax filers 25900 for joint filers or 19400 for heads of.

Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Lock Your Rate Today. Web One discount point usually costs 1 of your new mortgage and it reduces your rate by 025. The interest on an additional.

Web 5 tax deductions for homeowners 1. Homeowners who are married but filing. PdfFiller allows users to Edit Sign Fill Share all type of documents online.

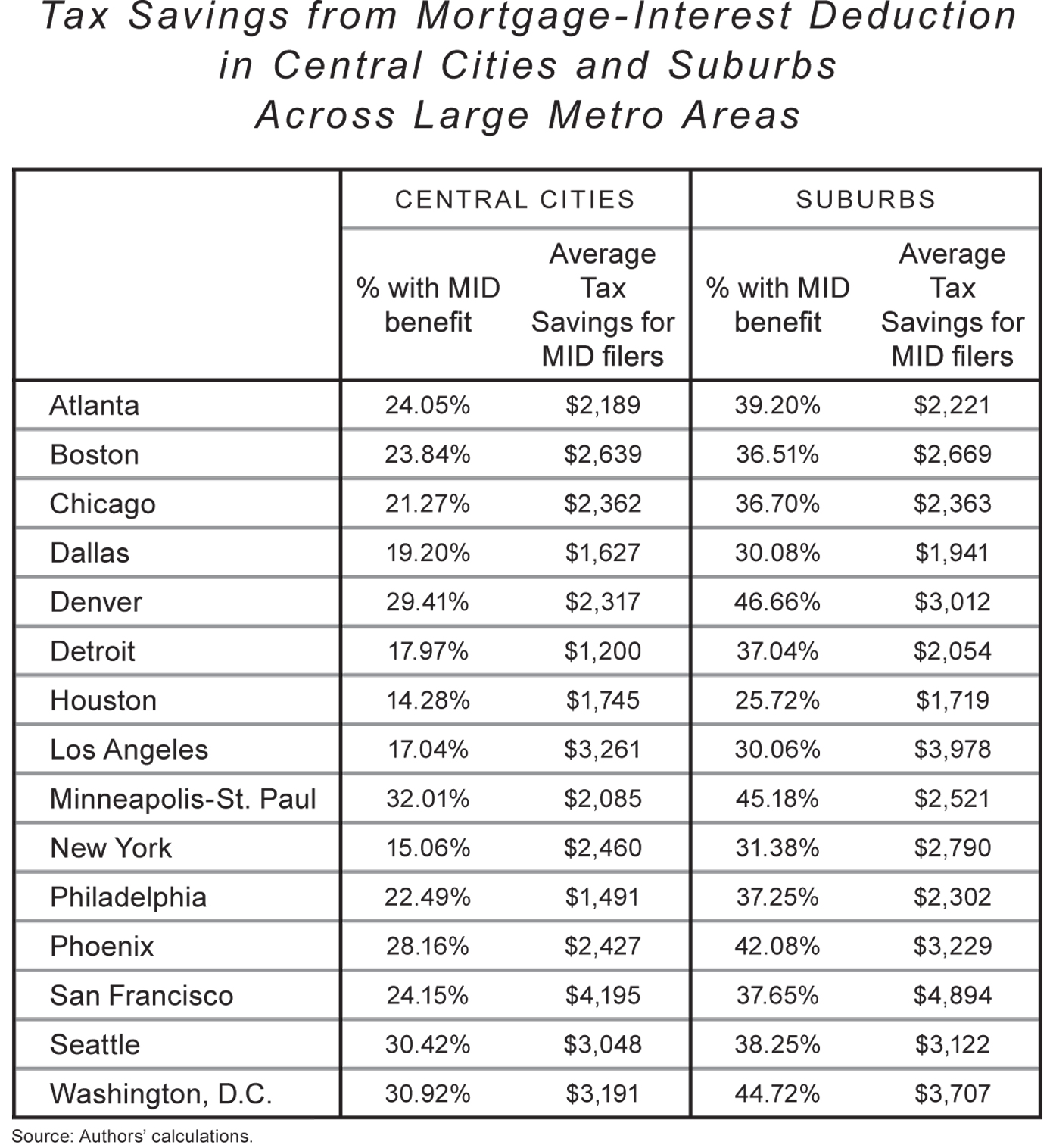

Rethinking Tax Benefits For Home Owners National Affairs

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Gutting The Mortgage Interest Deduction Tax Policy Center

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Or Standard Deduction Houselogic

Mortgage Interest Deduction Or Standard Deduction Houselogic

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

Theresa J Piper Team Captain Go Mortgage Linkedin

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Top 5 Tax Deductions For New Homeowners In Utah Liberty Homes

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Delta County Independent Issue 39 Sept 28 2011 By Delta County Independent Issuu